BUSINESS EXITS & ACQUISITIONS

Global M&A activity has reached new highs and yet the history of M&A is that most transactions fail to deliver predicted shareholder value. Two of the key reasons behind this high failure rate are misalignment of what success looks like for the transaction and conflicting goals, both of which contribute to low levels of trust and excess friction between the parties in the transaction.

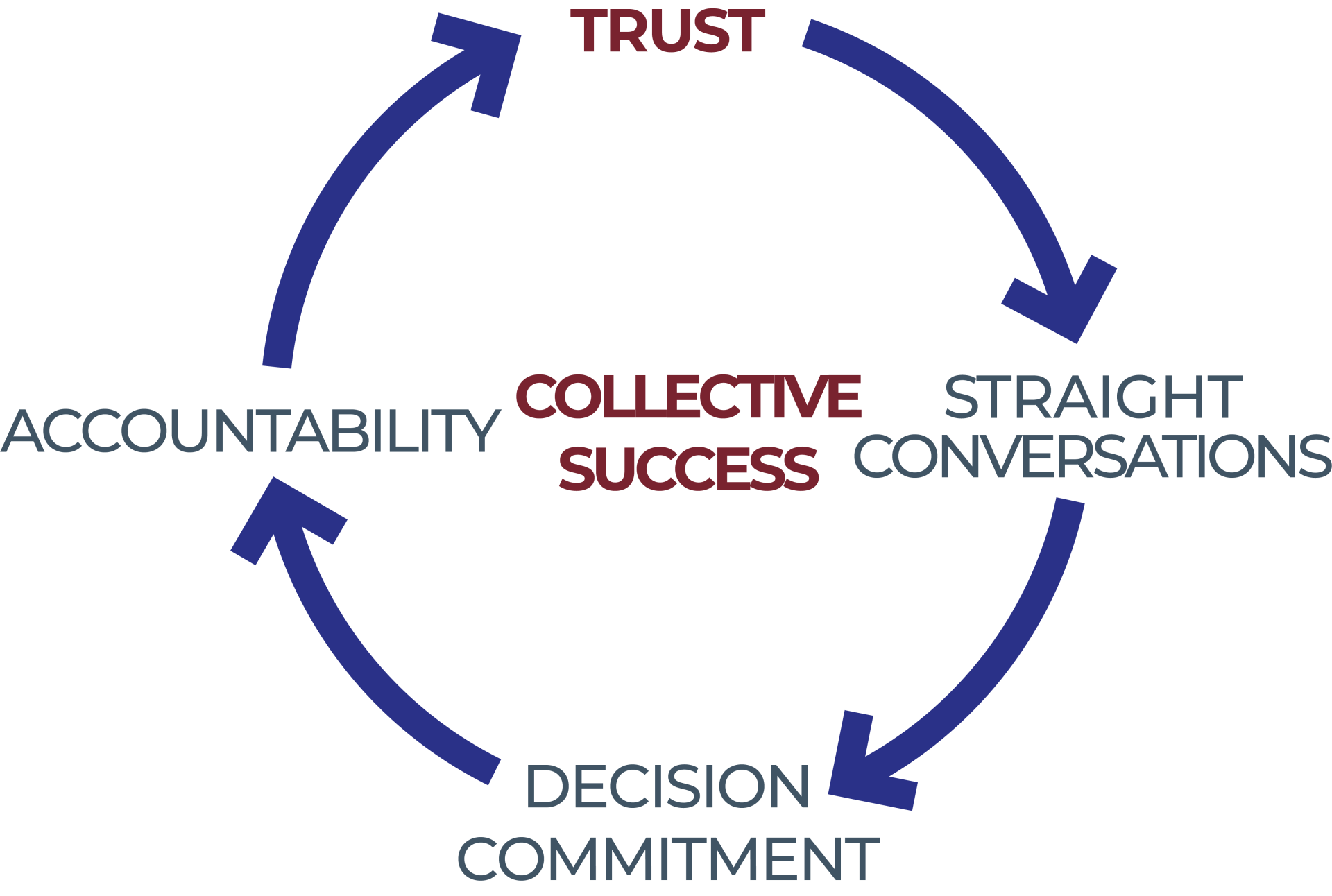

Experience has shown us that trust is the hidden ingredient in any successful transaction - we know if there is no trust, there is no hope. We work with teams to build that trust, not as a nice to have, but a critical variable to success and value creation. We work with executive teams pre-transaction to fully set the business up for a successful sale. Post transaction we work with both the acquired and the acquiring teams to clarify and align on what collective success looks like and the KPIs that will indicate success is being achieved.

Our unique approach focuses on both the commercial and the human elements that deliver a successful transaction

Are you set up to realize value from your transaction?

Is there strategic alignment across the executive team going into a sales process?

Are all members of the new leadership team fully aligned on the desired outcomes post transaction?

Have the risks and dependencies to strategy delivery been fully assessed by the new leadership team?

What is the level of trust across the new leadership team, and what can be done to improve it?

How do you create an open and candid environment focused on delivering desired outcomes?

How do you govern each other and hold each other to account?

Want more information?

A squared business performance coaching trading as The ParaGroup